10 Steps To Buy A House

Just 10 Steps to Buy a House — Your 2025 Homebuying Roadmap

Buying a Home: Where the Dream Begins

Buying a home is one of life’s biggest milestones — and one of the most rewarding investments you can make. Whether you’re a first-time buyer or ready to upgrade, the process can feel overwhelming without a clear plan.

That’s why I’ve broken it down into 10 simple, actionable steps to help you navigate your 2025 homebuying journey with confidence and clarity.

🧾 1. Assess Your Financial Readiness

Before house-hunting, take a close look at your finances. Review your credit score, savings, and monthly expenses to determine what you can comfortably afford.

💡 Tip: Use a mortgage calculator to estimate your monthly payment before you start looking.

💰 2. Get Preapproved for a Mortgage

Getting preapproved shows sellers that you’re a serious buyer. Lenders will evaluate your income, debts, and assets to determine your borrowing power — giving you a clear price range and stronger negotiation position.

👩💼 3. Find a Local Real Estate Agent

Partner with a trusted local Realtor who knows your target area inside and out. From market trends to neighborhood nuances, the right agent can help you find hidden gems and avoid costly mistakes.

“Local expertise isn’t just helpful — it’s your strongest advantage in today’s market.”

— Laura Graves, South Florida Realtor

🏠 4. Start House-Hunting

Make a list of your must-haves vs. nice-to-haves (bedrooms, location, schools, amenities) and start touring homes that align with your lifestyle. Remember: photos are helpful, but seeing a home in person tells the real story.

✍️ 5. Make an Offer

Work with your agent to write a competitive offer that reflects market value. Include key contingencies such as inspection, financing, and appraisal to protect your investment.

🔎 6. Schedule a Home Inspection

Never skip this step. A professional inspection uncovers potential issues — structural, plumbing, roofing, electrical — before you finalize the purchase.

📊 7. Get an Appraisal

Your lender will order an independent appraisal to confirm that the property’s value aligns with your offer price. This helps ensure you’re paying a fair market value.

🏦 8. Secure Your Financing

Once your offer is accepted, finalize your mortgage application and prepare all documentation. Avoid major financial changes (like new credit cards or car loans) until after closing.

🖋️ 9. Close the Sale

It’s time to sign, seal, and celebrate. Review your closing documents carefully, pay your closing costs, and officially become a homeowner.

📦 10. Move In & Make It Yours

Coordinate movers, set up utilities, and change your address. Then take a moment to enjoy your new space — you’ve earned it!

💬 Let’s Talk — What’s Your Next Step?

Which of these steps feels most challenging to you?

Have you bought before — or are you planning your first move in 2025?

Share your thoughts or questions in the comments below — I’d love to help guide you through your homeownership journey.

If you’re ready to explore listings or talk strategy, let’s connect.

📩 Email: [email protected]

📱 Call/Text: (786) 457-8001

🌐 Visit: LauraGravesRealEstate.com

🔑 Recommended Florida Listings

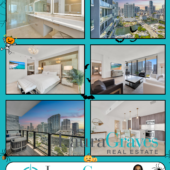

🏙️ 88 SW 7th St, Apt 2107 — Brickell, FL 33130

Luxury condo with breathtaking views, open living spaces, and a recent price reduction — perfect for urban professionals or investors.

👉 View Listing

🌳 318 NE 105th St — Miami Shores, FL 33138

A charming single-family home with lush landscaping and family-friendly spaces, ideal for first-time buyers looking for community and comfort.

👉 Explore Property

🏡 Final Word from Laura

“Buying a home should feel exciting — not intimidating.

My goal is to simplify every step so you can focus on what really matters: finding a home you love.”

— Laura Graves, South Florida Realtor